Trends to Watch in the Alcohol and Spirits Industries

At home drinking

Drinking in the comfort of our own homes was accelerated by the pandemic, with

40% of US consumers actively looking for cocktail kits at the end of 2020. And the best part is it isn't going away any time soon. A combination of affordable alcohol, convenience, easy online purchasing, and caution around re-entering public spaces will keep this revenue stream alive. Consumers are also experimenting with newer alcohol types like ready-made cocktails, causing the ready-to-drink (RTD) cocktails consumption to

grow by 43% in 2020. The RTD market continues to scale by 3% annually and is forecasted to reach around $32 billion by 2024's close.

The rise of brand values

Consumers are starting to pay closer attention to every alcohol brand mission and values. It's no longer enough to provide high-quality drinks. Consumers now want to know the impact brands are having on society and the environment. They're also keen to learn about the steps they're taking to make the world a better place. Some consumers feel so strongly about having aligning values with a brand that they make purchase decisions based on them.

Pushing boundaries in Tequila

There's a rise in female liquor masters from different ethnicities who prove alcohol distilling isn't a man's game but instead for passionate and driven entrepreneurs from all genders and walks of life. Trailblazers like Nayana Ferguson of

Teeq Tequila, founded the first black-woman-owned tequila brand, and Kumiko Zimmerman's

Don Sueños, launched the first Japanese woman-owned Tequila. Also, sisters and best friends

Kat Hantas, Nicole Emanuel, and Sarika Singh teamed up to shake up the tequila industry with all-natural, fruit-infused Tequila under their brand

21Seeds.

These female entrepreneurs turn social norms upside down by making big, bold moves in a male-dominated industry. There's no doubt their progress will only continue as the Tequila market is booming. Tequila sales have

grown by 22% since 2014 and are set to hit $14.7 billion by 2028, thanks to strategies like premiumization. Brands are riding the Tequila wave by bringing out new flavors, blends, and distilling techniques. Plus, this alcohol type has become social media famous, with #tequila gaining 4 billion views and counting on TikTok.

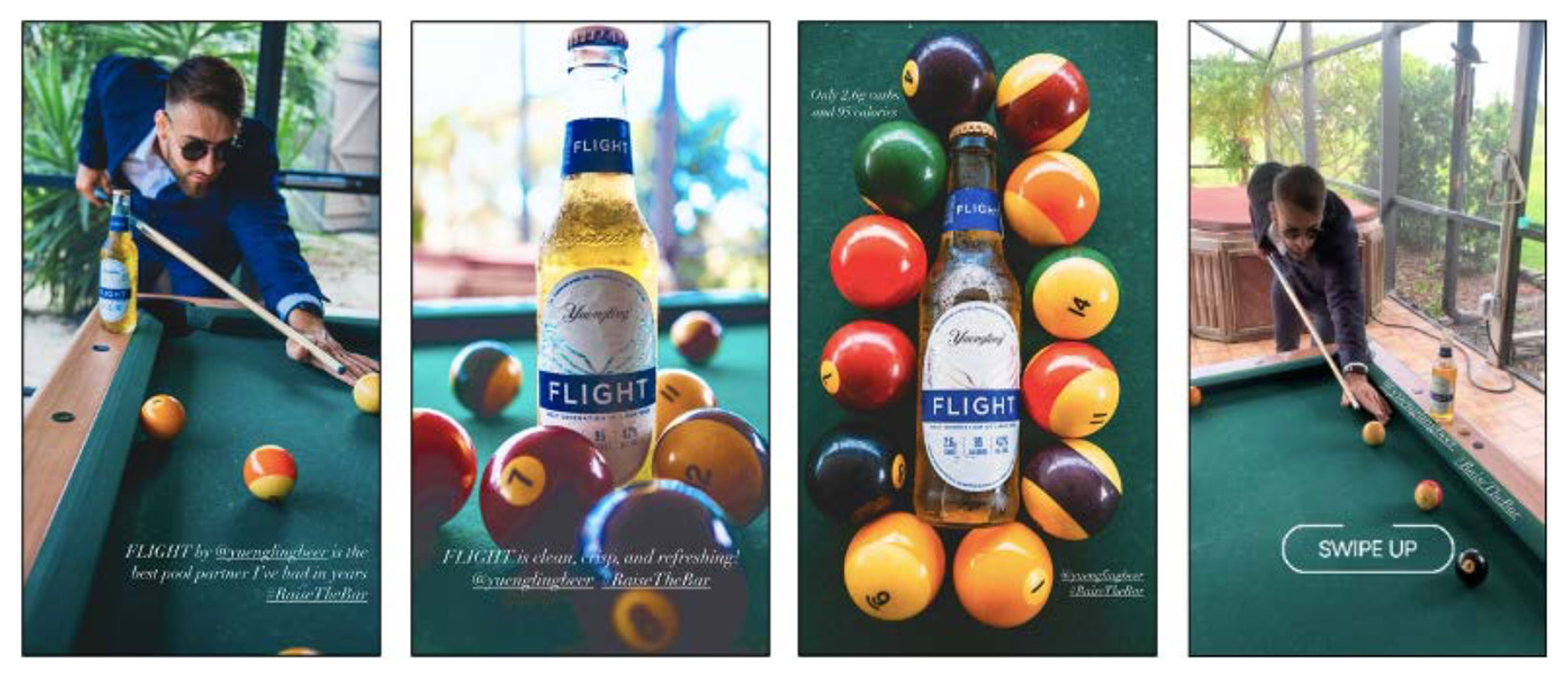

Premiumization

Over the past few years, there's been an increase in premium alcohol launches. With the pandemic giving consumers more disposable income coupled with consumers' desire to experiment, shoppers have begun to spend elsewhere like home activities and indulgences. Brands are capitalizing on this opportunity through premiumization, whether that's offering an upgraded version of an existing product or a new offering entirely like flavored Tequila and sustainable beer.

Alcohol alternatives

Non-alcoholic and low alcohol drinks are on the rise as some consumers pursue healthier lifestyles. This market's

sales grew by 32.7% in 2020. Healthier drinking options are causing a stir because they give shoppers the best of both worlds. For example, health-conscious consumers can now enjoy alcohol-free cider, beer, wine, and cocktails. They can enjoy the taste of alcohol while maintaining their health goals. Plus, alcohol alternatives have a great mental impact on teetotal individuals since they won't feel excluded from the fun when socializing as they'll have drinking options.